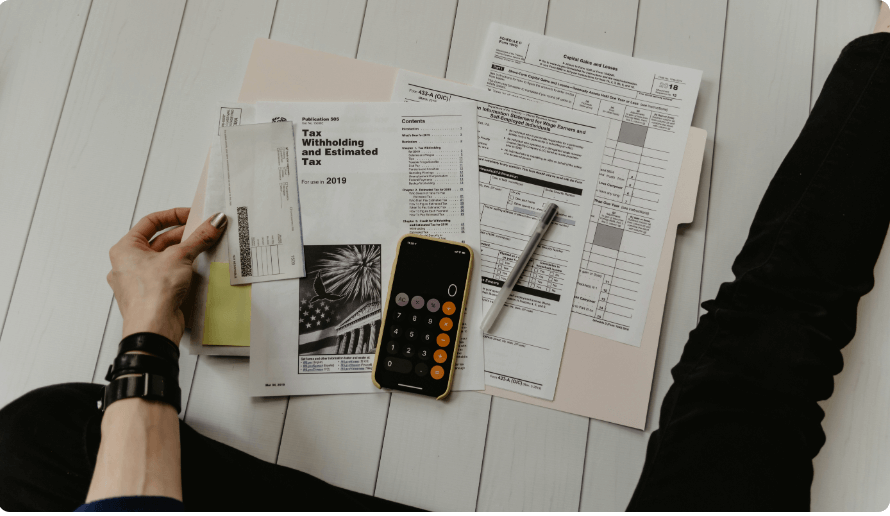

How to Get Started with Funding for Housing

Securing funding for housing can be essential for many individuals and families seeking to buy a home or cover housing expenses. This guide provides step-by-step instructions on how to get started with funding for housing.