How to Succeed in Apply for First Time Home Buyer Grant

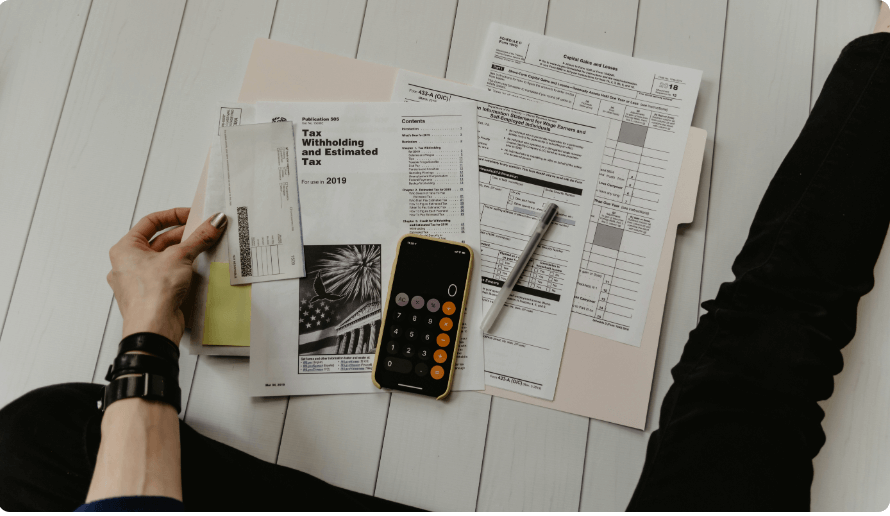

First-time homebuyer grants can provide financial assistance to help you purchase your first home. Succeeding in the application process requires understanding the eligibility criteria, preparing necessary documentation, and following the application steps carefully. This guide provides a comprehensive overview of how to successfully apply for a first-time homebuyer grant.