A financial advisor can provide personalized advice on how to use your HELOC strategically. They can help you plan withdrawals, manage repayments, and integrate your HELOC into your overall financial plan.

By following these advanced techniques, you can make the most of your HELOC and use it to achieve your financial goals. Strategic planning, monitoring interest rates, and consulting with a financial advisor can help you maximize the benefits of your home equity.

How to Succeed in Apply for First Time Home Buyer Grant

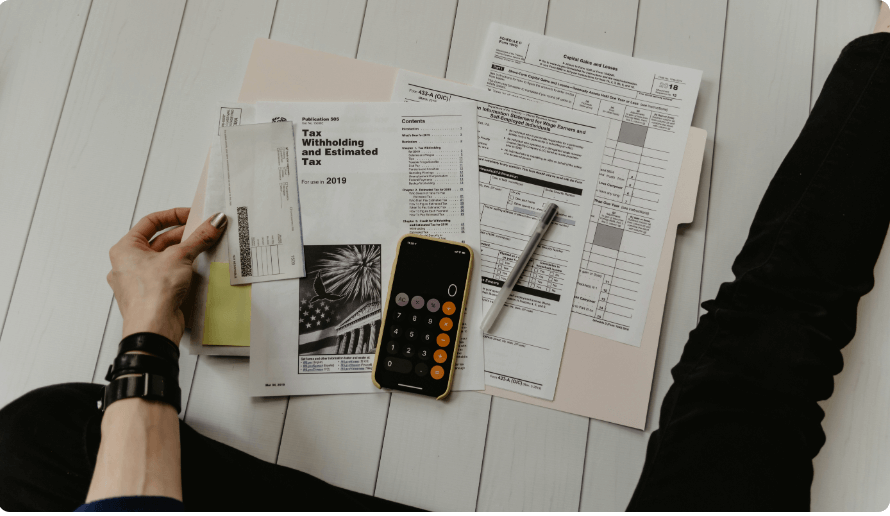

First-time homebuyer grants can provide financial assistance to help you purchase your first home. Succeeding in the application process requires understanding the eligibility criteria, preparing necessary documentation, and following the application steps carefully. This guide provides a comprehensive overview of how to successfully apply for a first-time homebuyer grant.